In case you didn't already know, I am a BIG TIME surfer. I will drop everything if the swell and conditions are right to surf 8 hours straight (or until my arms feel like they are about to fall off). Yes - that even means calling in "sick" to my 9 to 5 job.

I have been a part of Real Life Trading for about 9 months now, which has given me the opportunity to learn about trading first hand from some very successful traders. One of the traders in particular, James Gerard Connor, who I speak with often has inspired me recently to relate my passion for surfing with my other passion, stock trading. The similarities are astounding. Enjoy!

1. Surfing and stock trading are lifestyles

As a surfer, 90% of my decision making for what I do outside of my main work and projects has to do with whether or not the waves are firing. I will reschedule certain plans just so I can surf. If the waves are not firing, I find other stuff to do like go to the gym, work on my side business(s), study stock charts, or write articles like this one. The main reason why I moved to San Diego almost two years ago was so I could live in a place that consistently has good waves. For someone that grew up around the ocean, living without it was leading me down a road to depression when I lived in Houston, Texas. Not good. You will never see a surfer unhappy after they catch even one wave in a 3 hour session. In fact it is scientifically proven that surfing makes you a happier person. Not only do you have the physical and mental benefits of living your life around surfing, there's a huge social component that is unlike any other sport. While surfing seems like a solitary endeavor, an unspoken camaraderie exists in the lineup, especially when the waves are big and conditions are dangerous. It's all about watching out for each other. Surfing also introduces this thing called the travel bug. Once you have contracted it, you won't stop exploring the world and the beauty that is in it.

My friends and I hanging with the locals in Salina Cruz, Mexico

How does this relate to stock trading? For one if you really want to pursue something such as stock trading, you will have to make adjustments in your life so that you are able to trade certain times of the day. You want to be involved as much as you can. For example, my current 9 to 5 employer allows me to come into work between 10am-10:30am PST. This allows me to trade from 6:30am-9am PST. They understand that I am trading and are okay with it as long as I get my work done. I'm even allowed to bring in my personal laptop to trade at work, but I don't because I will get absolutely nothing done ;). Also stock trading might seem like a solitary endeavor like surfing, but there are an incredible amount of people in this community that will drop everything to help you out. Jerremy Newsome from reallifetrading.com and Joe Farah from atrtargettrading.com are examples of such fine people that keep you in check. They watch your back if you're in a trade, or considering entering one. They also drop an endless amount of knowledge on a consistent daily basis. Not to mention introduce you to many other successful traders in the industry.

My mentor, Joe Farah, and I

2. Baby steps

As with anything in life, you can't expect to be successful at trading unless you make incremental progress. It takes patience. If today was the first time you tried surfing, you aren't going to try and surf Pipeline are you? Heck no. You would start out surfing the more mellow waves on a longer board until you got the mechanics down for paddling, standing up, duck diving, avoiding people and riding the wave all the way to the end. Only then once your skill is sharpened would you move onto surfing bigger and stronger waves. In trading, this is the same thing as starting out with a small account (< $10,000). You don't want to trade with a lot of money right off the bat because I guarantee that you will lose money. Some days more than others, but it is inevitable in the trading world. Trust me when I say that it's better to make these mistakes trading a small amount of money. Don't get false confidence thinking you can trade better with more money just like some people starting out surfing think they are ready to surf overhead waves because they rode 2 foot waves on a Wavestorm.

3. Dedication and perseverance to not give up

Surfing is physically and mentally demanding. When you first start out surfing, you think "How hard can it be?". As you listen to experienced surfers provide their advice on what to focus on, you mute them out thinking you got this 100%. Not even 5 minutes in to paddling out through the shorebreak, you realize how difficult surfing really is. You get rejected for the next 30 minutes and finally give up since you can barely stay on the board, let alone breathe normal. First thought I guarantee comes to your mind is that I quit because surfing it is too difficult. You didn't even make it to the middle break. Why? Because you didn't have the strength in the right muscles that surfing requires to propel you through the waves to the outside. Once you figure that part out, which could take months, the next challenge is paddling to catch the wave, pop up on your board, make the drop, and finally surf the wave without running into other surfers that are paddling out. The point is that most surfers that are really good dedicate a lot of time to getting stronger and working on their technique so they progress so they can eventually surf high performance waves. Along the road they will hit speed bumps such as getting injured, breaking a board and falling on maneuvers that they should easily land.

Trading is the same way. You might have thoughts of rolling in the dough before you make your first trade. You may even have a few successful trades in a row, which in my opinion is the WORST thing that could happen to someone when they start trading. You quickly realize those first few wins were pure luck as you begin to lose consistently over and over and over again. The false confidence that has built up from your initial winners may have even gave you the idea to trade with a larger position since you can't lose right? Wrong. Just like with surfing, you will experience the occasional failure (losses) that will make you feel like quitting. But by being dedicated to constantly improving your knowledge and mental state, and persevering through the extremely rough times when you lose money (a lot sometimes), you too will be riding the epic wave of the stock market.

4. Picking and choosing waves (your sweet spot)

When surfing you always want to catch the biggest wave of the day. Think of this as trying to hit a homerun in a trade (going all in). But when the waves are really, really big, you have to pick and choose your battles. A wave too big and you might hurt or kill yourself. A wave too small might not get your blood flowing. But a medium size wave is where it's at. Just the right size and shape to pull into a barrel and/or do a huge turn on without the fear of getting dragged along the bottom, or hitting your head (I have done both).

Relate this to trading by the biggest wave of the day being the volatile market we are currently in. A really big wave, or you trying to hit a homerun trading can end badly, i.e. huge loss or blow up your account. A small wave, or you scalping or only having small winning trades, can limit your account growth. Only one regular loss can wipe out gains from 2-3 small wins. But a medium wave, or a trade that has conviction behind it for at least 1R or more, is the sweet spot. It won't make you feel uncomfortable for risking too much, and it will keep your "fear" to a minimum.

5. Finding that perfect board (your trading strategies and rules)

The average surfer seems to understand the importance of diversification, but most investors and traders struggle with this simple concept. Ocean conditions are rarely the same as yesterday, which is why a surfer has a quiver of boards. A quiver is just a selection of boards where each board is designed to be used in certain conditions. Some boards are better in smaller, weaker waves, but would be a terrible idea in large waves. As a trader, you need to a quiver of strategies and rules on how you should trade certain market conditions. A conservative strategy that uses a smaller position size in an extremely volatile market is an efficient way to ride the current wave the stock market is giving you. Usually it takes time and experimenting to figure out how to match trading strategies and rules with the current pace of the market.

6. That "in the zone" feeling

After over 15 years of surfing, this "in the zone" feeling comes naturally to me. When I paddle out at a break, I'm paying attention to all my surroundings: the tide, the crowd, the waves, the current, where to paddle out, potential wildlife in the area, etc. When I paddle out, I figure out where to sit to catch the set waves. And when a set wave comes in, I instinctively start paddling to position myself to takeoff on the most critical part of the wave. Dropping in is so natural that I don't even think about where my feet are, but I know that they will land in the right spots. The same can be said when surfing the wave. My body just moves where it needs to be in order to speed up, slow down, and turn the board on the wave. In a strange way it's like I am one with the wave.

Similar in stock trading, when you're in the zone you are recognizing trade setups and executing on them without hesitation. In essence you are operating like a robot, which is the best way to trade since you have no fear of losing, but are being logical in your decision making.

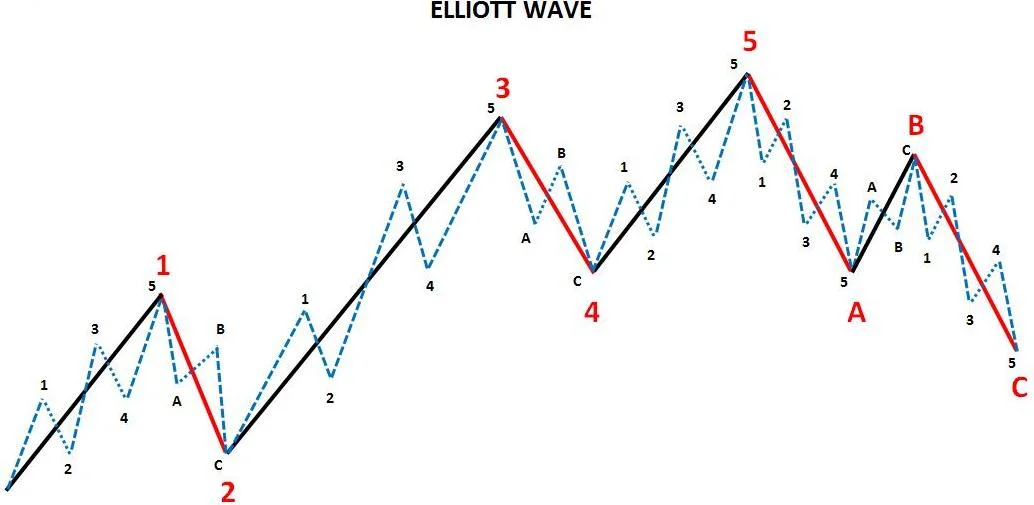

7. Stock prices literally move like ocean waves

If you ever stared at the ocean for at least 30 minutes, you will see changes in the water surface due to waves heading towards shore. These waves were created by some storm in the ocean where the wind constantly blew until a ripple turned into a decent sized wave that began pushing in the direction of the wind. The stronger the wind blows, the bigger the wave becomes. Think about stock prices for second. What causes them to move up? Positive news, or buying pressure from a raging bull market. Certain conditions create a either a mediocre move, or giant move up in price. Now these waves have a certain amount of energy that gets released when they reach a shallow area causing them to either crumble then reform, or break completely. When a wave crumbles then reforms, this is when stock price has increased a certain amount, but needs to reset before going higher. When a wave breaks completely, the stock price is going to decrease until all the energy has been released. Stock prices are essentially made up of many waves that are formed then break with a certain intensity.

8. There will always be another wave

As frustrated as a surfer might get for missing what they think was the best wave of the day, they will quickly remember that there is ALWAYS another wave coming in. Might be in the next 5 minutes, or the next hour. But it is 100% certain that there will be another wave and usually that wave is twice as good as the one that got away. In trading this is no different. If you recognize a trade setup and aren't able to execute in time, don't sweat it. The stock market presents hundreds, if not thousands, of opportunities per day to make money. Have that abundance mindset and let the next trade come to you.

Hope you enjoyed this killer article!!