As you begin your journey as a trader, one of the most basic things you need to know is the different types of orders and when they are appropriate.

In this post, we'll cover the basic types of stock market orders and when you should use them.

Here is a video format of the same blog post:

What is a Trade Order?

Before going into the order types, let's understand the absolute basics of what a trade order is:

“Buy” button to enter a long position (bullish).

You now must sell to exit your long position.

“Sell” button to enter a short position (bearish).

You now must buy to exit your short position.

Simply executing buy and sell orders is inefficient and will result in slippage!

Slippage: the difference between where you tried to enter a position and where you were filled based on the bid/ask spread.

Market Order

A market order is the most basic order type there is, but we recommended to never enter a trade using this order type:

“Buy” button to enter a long position (bullish).

“Sell” button to enter a short position (bearish).

Buy market orders are filled on the best offer and sell market orders are filled on the best bid!

AKA the current market price.

Will result in high slippage in a fast-moving market!

Limit Order

A limit order is the most common type of order, and we recommend to always enter a trade using this order type:

“Buy” button to enter a long position below current market price (bullish).

“Sell” button to enter a short position above current market price (bearish).

Buy limit and sell limit orders are filled at a specific price or better!

Will NOT result in slippage in a fast-moving market!

ALWAYS use this order type to enter a trade!

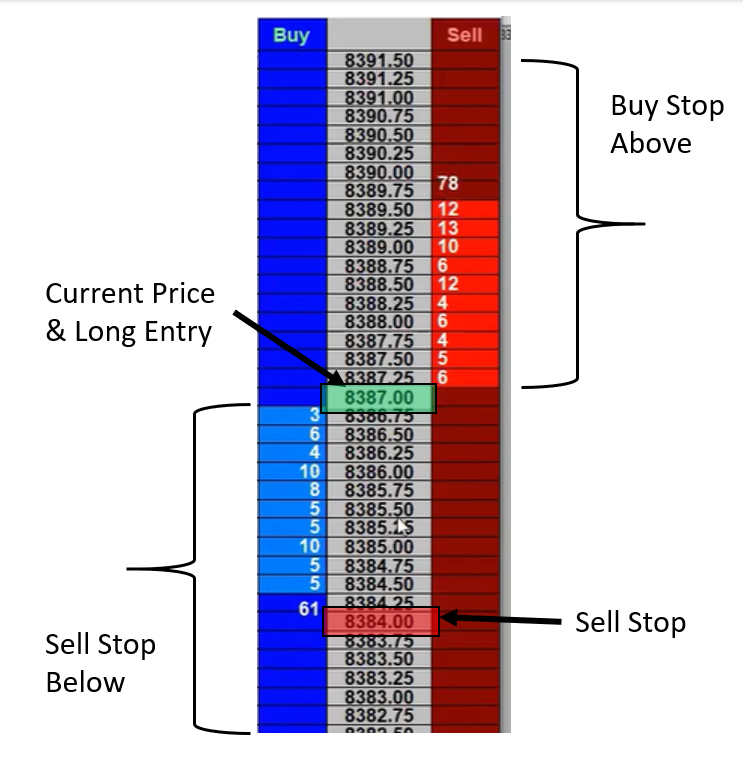

Stop Order (Stop Loss)

A stop order should always be used after entering a trade using a limit order:

“Buy” button to exit a short position above current market price (bearish).

“Sell” button to exit a long position below current market price (bullish).

Buy stop and sell stop orders are executed at market once price reaches the order price!

Could result in slippage in a fast-moving market, but is there for your protection!

ALWAYS use this order type to exit a trade, and protect your profits!

Stop-Limit Order

A stop-limit order combines a stop order and a limit order:

“Buy” button to enter a long position above current market price (bullish).

“Sell” button to enter a short position below current market price (bearish).

Buy stop-limit and sell stop-limit orders become limit orders once price hits the stop price!

Will NOT result in slippage in a fast-moving market!

This order type can be used for momentum trades!

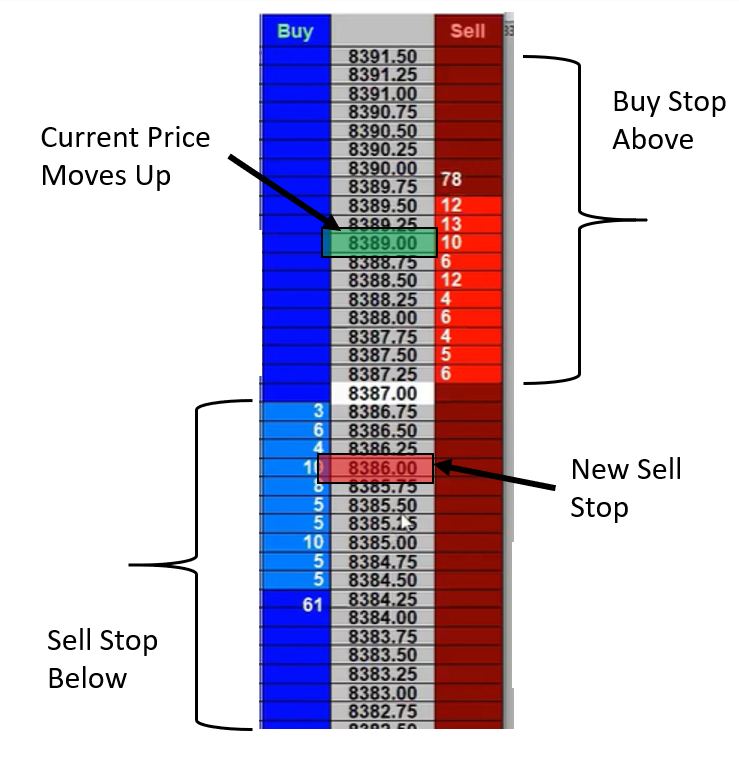

Trailing Stop Order

A trailing stop order is less common, but used to lock in profits or reduce risk as the trade works in your favor:

“Buy” button to exit a short position above current market price (bearish).

“Sell” button to exit a long position below current market price (bullish).

Buy trailing stop and sell trailing stop orders are based on the % or $ movement and executed at market once price reaches the order price!

Could result in slippage in a fast-moving market, but is there for your protection!

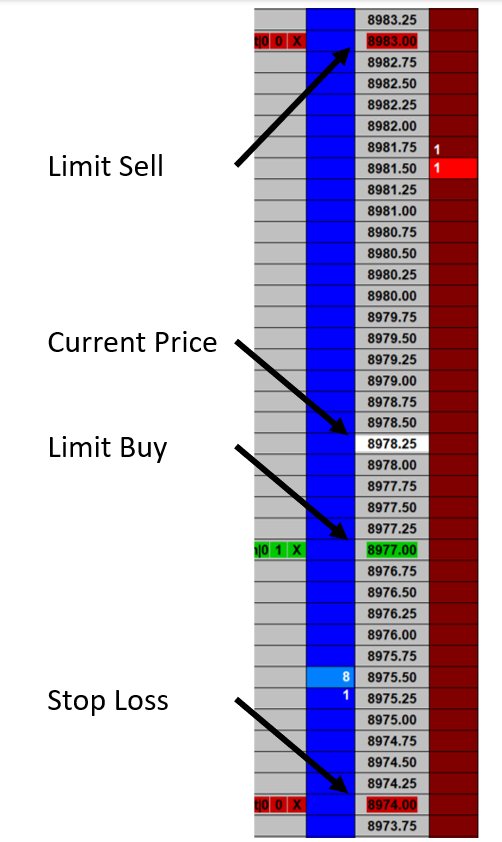

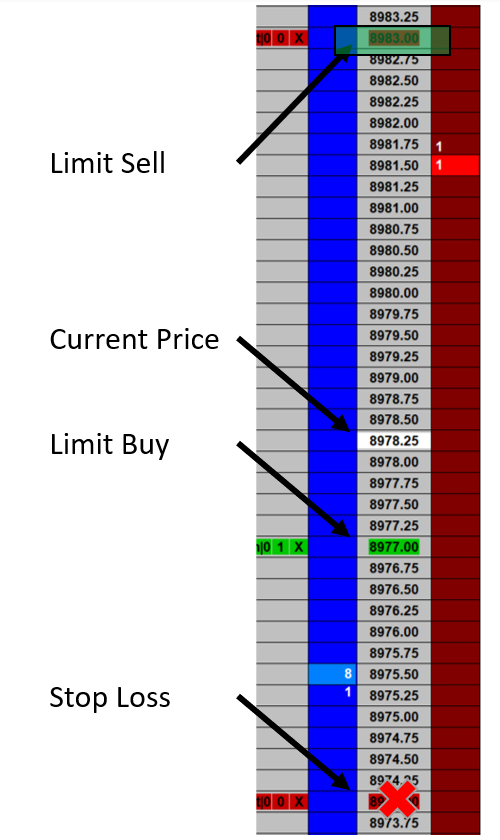

One-Cancels-the-Other (OCO) Order

An OCO order combines a stop loss order with a market, limit, or stop-limit order for both your target profit and entry.

Example:You want to buy NQ futures at 8977 with a 3 point stop loss and 6 point profit:

Price hits 8977 or lower to fill your limit buy.

The stop loss at 8974 and limit sell at 8983 are automatically submitted!

Price hits your limit sell (profit target) at 8983. Your stop loss order is cancelled.

Flatten, Reverse and Cancel All

“Flatten” button will close all open positions and cancel all open orders.

“Reverse” button will reverse your position as a market order:

If you are long, hitting reverse will submit two sell market orders to make your net position short.

If you are short, hitting reverse will submit two buy market orders to make your net position long.

“Cancel All” button will cancel all open orders.

This button will NOT close an open position!